Introduction

In today's digitalized world, the threat of fraud has become a growing concern for businesses of all sizes. Fraudulent activities can have devastating consequences, leading to financial losses, damaged reputations, and erosion of customer trust. To combat this challenge, businesses must adopt robust fraud detection strategies that leverage the power of business process modeling (BPM).

This blog post will delve into the benefits of using BPM for fraud detection, highlighting how it can help organizations streamline their operations, identify potential vulnerabilities, and implement effective countermeasures. By the end of this article, you'll have a comprehensive understanding of how BPM can revolutionize your approach to fraud detection and strengthen your organization's overall security posture.

The Importance of Fraud Detection in Business

Fraud, in its various forms, is a significant threat to businesses worldwide. According to a report by the Association of Certified Fraud Examiners (ACFE), the global cost of fraud is estimated to be around $4.5 trillion per year. This staggering figure underscores the critical need for businesses to prioritize fraud detection and prevention strategies.

Failing to address fraud can lead to a myriad of consequences, including:

- Financial Losses: Fraudulent activities can result in direct monetary losses, as well as indirect costs such as legal fees, investigation expenses, and reputational damage.

- Reputational Damage: A high incidence of fraud can severely tarnish a company's reputation, making it challenging to retain existing customers and attract new ones.

- Regulatory Compliance Issues: Many industries are subject to strict regulations regarding fraud prevention and detection. Non-compliance can result in hefty fines and other legal consequences.

- Operational Disruptions: Addressing fraud can be time-consuming and divert resources away from core business activities, leading to operational inefficiencies and potential lost opportunities.

Business Process Modeling for Fraud Detection

Business process modeling (BPM) is a powerful tool that can help organizations streamline their operations and identify potential vulnerabilities, including those related to fraud. By mapping out the various processes and workflows within a business, BPM provides a holistic understanding of how the organization functions, enabling the identification of weak points and the implementation of targeted solutions.

Here are some key ways in which BPM can revolutionize your approach to fraud detection:

1. Visualizing Processes and Workflows

One of the primary benefits of BPM is its ability to create visual representations of a business's processes and workflows. This allows organizations to gain a deeper understanding of how information and data flow through their systems, making it easier to identify potential points of vulnerability.

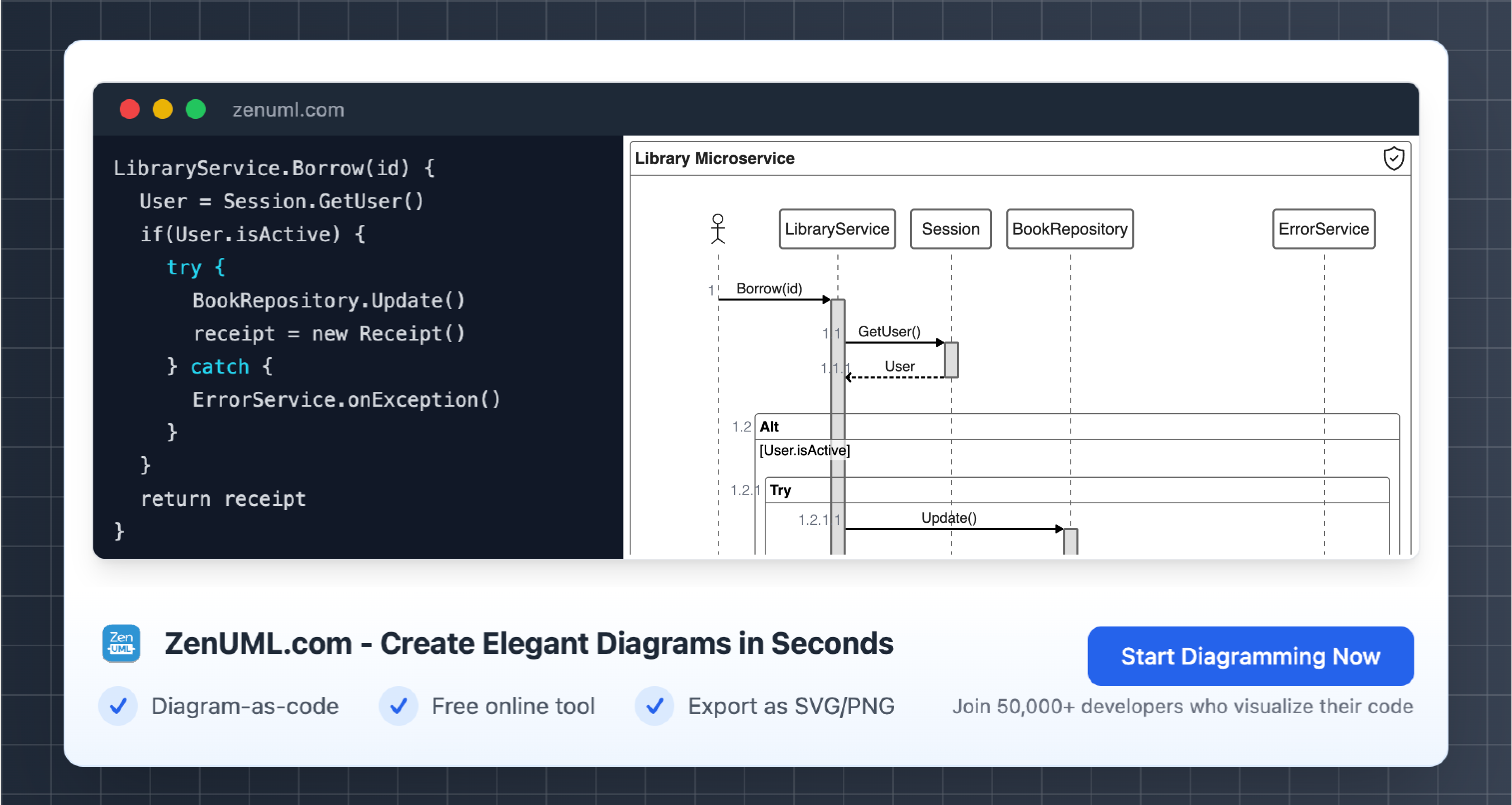

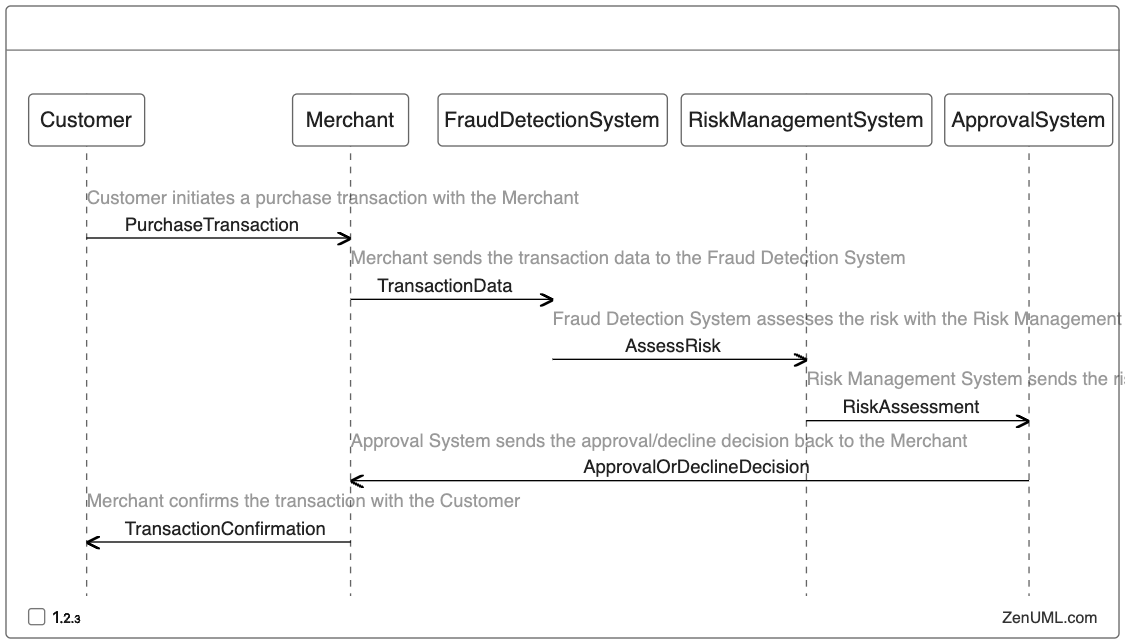

Here's an example of a sequence diagram using ZenUML that illustrates a typical fraud detection process:

By visualizing the process, businesses can quickly identify areas where fraud may be more likely to occur, such as the handoff between the merchant and the fraud detection system, or the communication between the risk management system and the approval system.

2. Identifying Process Inefficiencies and Vulnerabilities

BPM enables businesses to analyze their processes in-depth, revealing potential inefficiencies and vulnerabilities that could be exploited by fraudsters. This analysis can uncover issues such as:

- Lack of data validation: Processes that fail to thoroughly validate customer or transaction data can leave the system open to manipulation.

- Insufficient access controls: Weak or inconsistent access controls can allow unauthorized individuals to gain access to sensitive information or systems.

- Inadequate monitoring and reporting: Processes that lack robust monitoring and reporting capabilities may fail to detect fraudulent activities in a timely manner.

By addressing these vulnerabilities through process improvements, businesses can significantly enhance their fraud detection capabilities.

3. Streamlining Fraud Detection Workflows

BPM can also help organizations streamline their fraud detection workflows, ensuring that suspicious activities are identified and addressed in a timely and efficient manner. This can involve:

- Automating fraud detection processes: Automating tasks such as data analysis, risk assessment, and decision-making can improve the speed and accuracy of fraud detection.

- Integrating multiple systems: BPM can facilitate the integration of various systems (e.g., customer relationship management, payment processing, and risk management) to create a more comprehensive fraud detection approach.

- Improving collaboration and communication: BPM can enhance collaboration between different departments (e.g., finance, IT, and legal) and improve communication throughout the fraud detection process.

By streamlining their fraud detection workflows, businesses can respond more quickly to emerging threats, reducing the overall impact of fraudulent activities.

4. Enhancing Fraud Detection Analytics

BPM can also support the development and implementation of advanced fraud detection analytics. By modeling and analyzing business processes, organizations can:

- Identify patterns and anomalies: BPM can help businesses detect unusual patterns or anomalies in their processes that may indicate fraudulent activities.

- Develop predictive models: By understanding the underlying processes, businesses can create predictive models to anticipate and prevent potential fraud scenarios.

- Optimize decision-making: BPM can inform the decision-making process by providing insights into the potential impact of various fraud detection strategies.

Integrating fraud detection analytics with BPM can enable businesses to proactively identify and mitigate fraud risks, rather than simply reacting to incidents after the fact.

Implementing BPM for Fraud Detection: A Step-by-Step Approach

Implementing BPM for fraud detection is a multi-step process that requires a strategic and structured approach. Here's a step-by-step guide to help you get started:

-

Assess Your Current Fraud Detection Capabilities: Begin by evaluating your organization's existing fraud detection processes, systems, and capabilities. Identify areas of strength, weakness, and potential improvement.

-

Map Your Business Processes: Utilize BPM tools and techniques to create visual representations of your organization's key business processes, from customer onboarding to transaction processing and beyond.

-

Analyze Process Vulnerabilities: Carefully examine your business processes to identify potential points of vulnerability where fraud may occur. Look for areas with weak controls, insufficient data validation, or lack of monitoring and reporting.

-

Develop Fraud Detection Strategies: Based on your process analysis, develop targeted fraud detection strategies that address the identified vulnerabilities. This may involve implementing new controls, automating processes, or enhancing data analytics capabilities.

-

Integrate Fraud Detection into Business Processes: Seamlessly integrate your fraud detection strategies into your business processes, ensuring that they are an integral part of your organization's operations.

-

Continuously Monitor and Improve: Regularly review and update your fraud detection processes, incorporating feedback, lessons learned, and emerging threats to maintain their effectiveness.

By following this step-by-step approach, you can leverage the power of BPM to revolutionize your organization's fraud detection capabilities, ultimately protecting your business, customers, and stakeholders from the devastating impacts of fraud.

Conclusion

In today's complex business landscape, effective fraud detection is a critical imperative for organizations of all sizes. By embracing the power of business process modeling, businesses can gain a deeper understanding of their processes, identify vulnerabilities, and implement targeted solutions to mitigate the threat of fraud.

Through the use of visual tools like sequence diagrams, BPM enables businesses to streamline their fraud detection workflows, enhance their analytical capabilities, and proactively address emerging threats. By integrating BPM into their fraud detection strategies, organizations can navigate the ever-evolving landscape of fraud with confidence and resilience.

As you embark on your journey to revolutionize your fraud detection approach, we encourage you to embrace the transformative potential of business process modeling. By doing so, you'll not only safeguard your business but also forge a path towards a more secure and prosperous future.

We'd love to hear your thoughts and experiences on the role of BPM in fraud detection. Please feel free to share your insights, challenges, and success stories in the comments section below.

Try ZenUML now!

Zenuml detailed feature roadmap available here.