Streamlining Policy Underwriting: Optimizing Business Processes with Sequence Diagrams

In the dynamic world of insurance, the policy underwriting process is a critical component that can make or break an organization's success. Effective business process modeling is essential to ensure seamless operations, enhance efficiency, and deliver exceptional customer experiences. This blog post delves into the art of streamlining policy underwriting, leveraging the power of sequence diagrams to visualize and optimize the underlying business processes.

Mastering Policy Underwriting: The Importance of Efficient Processes

Policy underwriting is the cornerstone of the insurance industry, responsible for assessing risk, determining coverage, and setting appropriate premiums. According to a recent study by the Insurance Information Institute, the global insurance industry generated over $6.3 trillion in premiums in 2021, underscoring the immense scale and significance of this critical function.

However, the policy underwriting process can often be complex, involving multiple stakeholders, extensive data gathering, and complex decision-making. Inefficient processes can lead to costly delays, customer dissatisfaction, and missed opportunities. This is where the power of business process modeling comes into play.

Visualizing the Policy Underwriting Process with Sequence Diagrams

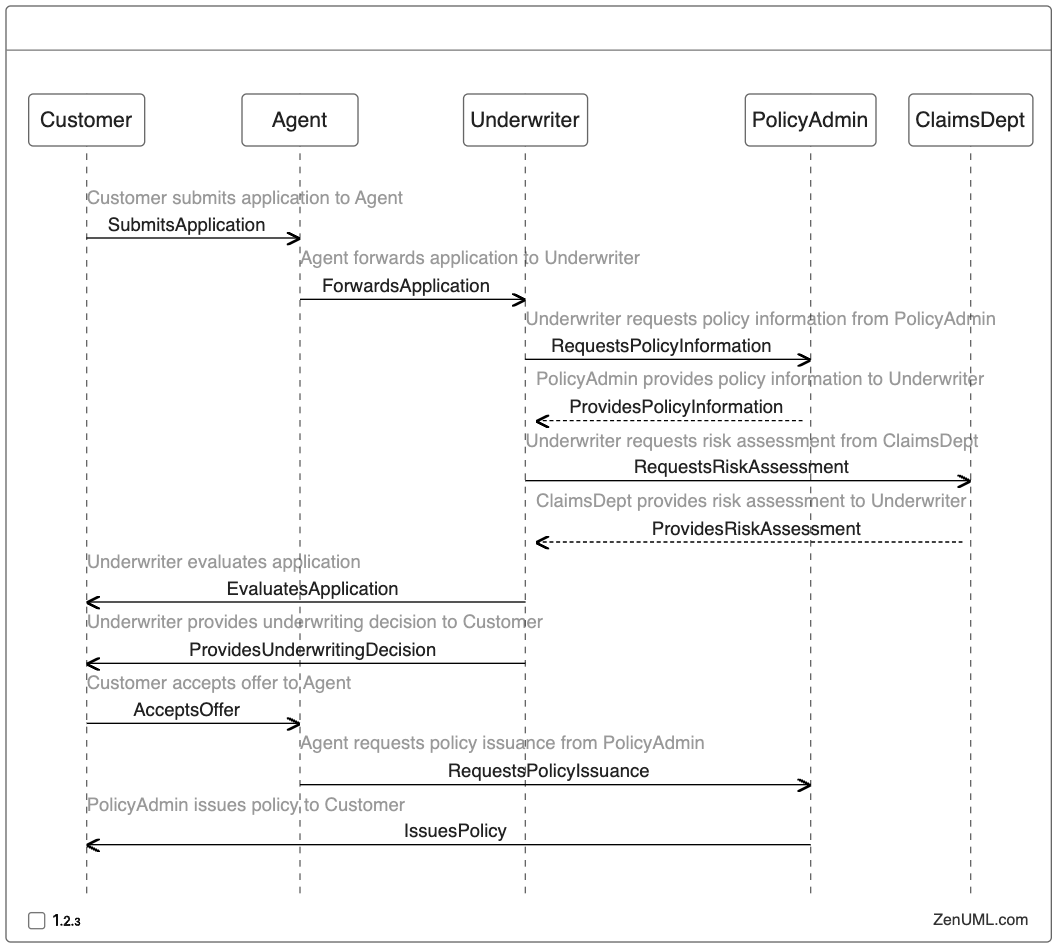

Sequence diagrams are a powerful tool in the realm of business process modeling, providing a clear and concise way to visualize the interactions and flow of information between various entities involved in a particular process. In the context of policy underwriting, sequence diagrams can help organizations map out the entire lifecycle, from initial application to policy issuance and beyond.

Here's an example of a sequence diagram that illustrates the policy underwriting process:

By visualizing the policy underwriting process in this manner, organizations can gain a deeper understanding of the various touchpoints, decision-making points, and information flows involved. This, in turn, allows them to identify areas for improvement, streamline processes, and enhance overall efficiency.

Optimizing the Policy Underwriting Process

Armed with the insights gleaned from the sequence diagram, organizations can embark on the journey of optimizing their policy underwriting processes. Here are some key strategies to consider:

-

Streamlining Data Gathering: Identify opportunities to automate data collection and eliminate redundant information requests, reducing the burden on both customers and internal teams.

-

Enhancing Communication and Collaboration: Ensure seamless communication and collaboration between the various stakeholders involved, such as agents, underwriters, and policy administration teams, to minimize delays and improve decision-making.

-

Leveraging Technology: Invest in advanced insurance technology solutions, such as intelligent process automation, data analytics, and artificial intelligence, to enhance the accuracy and speed of the underwriting process.

-

Continuous Process Improvement: Regularly review and refine the policy underwriting process, incorporating feedback from customers, agents, and internal teams to drive ongoing optimization and innovation.

By implementing these strategies, organizations can unlock the true potential of their policy underwriting processes, driving increased efficiency, cost savings, and customer satisfaction.

The Impact of Optimized Policy Underwriting

The benefits of optimized policy underwriting processes can be far-reaching and impactful. According to a report by McKinsey & Company, insurance companies that have successfully digitized their underwriting processes have seen a 15-20% reduction in operating costs and a 10-15% increase in new business.

Moreover, improved underwriting efficiency can lead to faster policy issuance, enhanced customer experience, and better risk management. This, in turn, can result in increased customer loyalty, higher retention rates, and a stronger competitive advantage in the market.

Conclusion: Embracing the Power of Sequence Diagrams

In the dynamic insurance landscape, the policy underwriting process is a crucial component that demands constant attention and optimization. By leveraging the power of sequence diagrams, organizations can gain a comprehensive understanding of their business processes, identify areas for improvement, and implement strategic initiatives to streamline operations.

As you embark on your journey to optimize your policy underwriting processes, remember that the key to success lies in embracing the insights provided by sequence diagrams and taking a holistic, data-driven approach to process improvement. With the right strategies and tools in place, you can unlock new levels of efficiency, enhance customer experiences, and drive sustainable growth for your organization.

We'd love to hear your thoughts and experiences on streamlining policy underwriting processes. Share your insights in the comments section below, and let's continue this important conversation.

Try ZenUML now!

Zenuml detailed feature roadmap available here.