Introduction

In the ever-evolving world of finance, understanding and documenting the intricate flow of financial transactions is crucial for effective communication, system design, and process optimization. One powerful tool that can help achieve this is the sequence diagram, a vital component of the Unified Modeling Language (UML). Sequence diagrams provide a visual representation of the interactions between different entities, or actors, involved in a specific scenario, making them an invaluable asset in the financial industry.

This blog post will explore the benefits of using sequence diagrams to model financial transactions, providing practical examples and illustrations using the ZenUML sequence diagram syntax. By the end of this article, you will have a comprehensive understanding of how sequence diagrams can enhance your financial modeling and communication efforts.

The Importance of Sequence Diagrams in Financial Transactions

Financial transactions are complex processes that involve multiple stakeholders, systems, and intermediaries. Sequence diagrams offer a clear and concise way to document these interactions, making them easier to understand, analyze, and optimize.

Here are some key reasons why sequence diagrams are crucial in the financial sector:

-

Process Visualization: Sequence diagrams provide a visual representation of the flow of financial transactions, allowing stakeholders to quickly understand the various steps involved and the interactions between different parties.

-

Communication and Collaboration: By presenting a common visual language, sequence diagrams facilitate effective communication and collaboration among teams involved in the development, implementation, and maintenance of financial systems.

-

System Design and Optimization: Sequence diagrams can be used to analyze the efficiency and scalability of financial transaction processes, identify bottlenecks, and develop more streamlined and effective solutions.

-

Regulatory Compliance: In the heavily regulated financial industry, sequence diagrams can be used to document and demonstrate compliance with various regulations and industry standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

-

Training and Documentation: Sequence diagrams can serve as valuable training resources, helping new employees or stakeholders understand the intricacies of financial transaction workflows, and can also be used to document and preserve institutional knowledge.

Practical Examples of Sequence Diagrams for Financial Transactions

To illustrate the power of sequence diagrams in the financial domain, let's explore several practical examples using the ZenUML sequence diagram syntax.

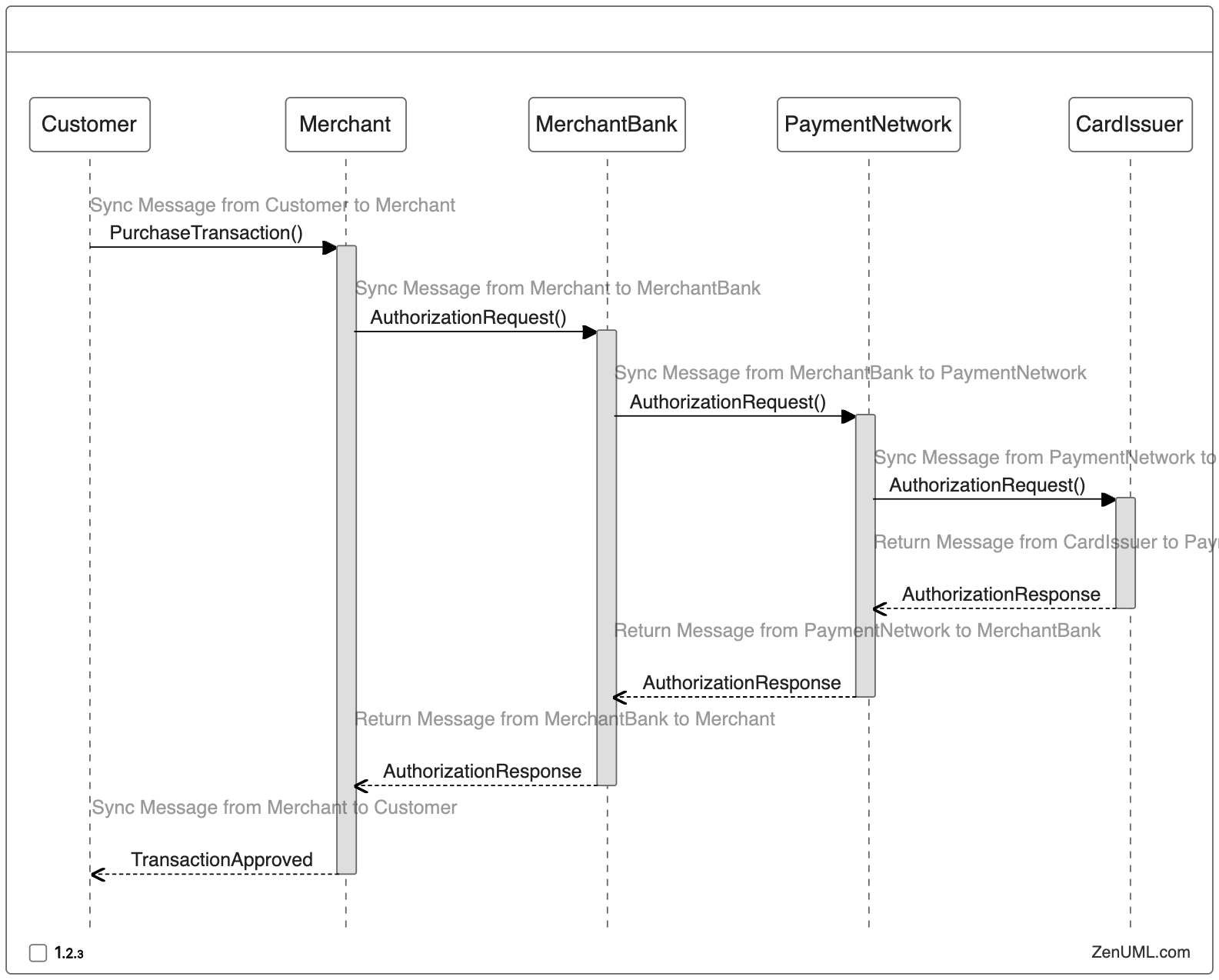

Example 1: Credit Card Transaction Processing

Let's consider a typical credit card transaction process, involving the customer, the merchant, the merchant's bank, the card issuer, and the payment network.

This sequence diagram illustrates the step-by-step process of a credit card transaction, from the customer's initial purchase to the final authorization and approval. By visualizing the interactions between the various entities, it becomes easier to understand the flow of information and identify potential areas for optimization.

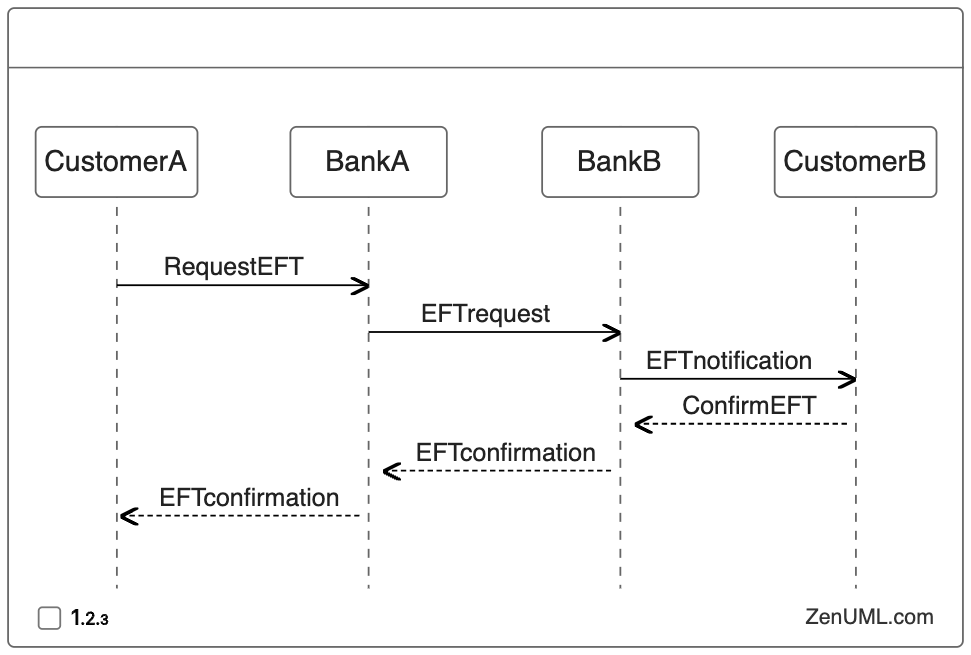

Example 2: Electronic Funds Transfer (EFT) between Bank Accounts

In this example, we'll model the sequence of events involved in an electronic funds transfer between two bank accounts.

This sequence diagram illustrates the flow of an electronic funds transfer, involving the customer initiating the request, the sending bank processing the transfer, the receiving bank notifying the recipient, and the confirmation being sent back to the originating customer.

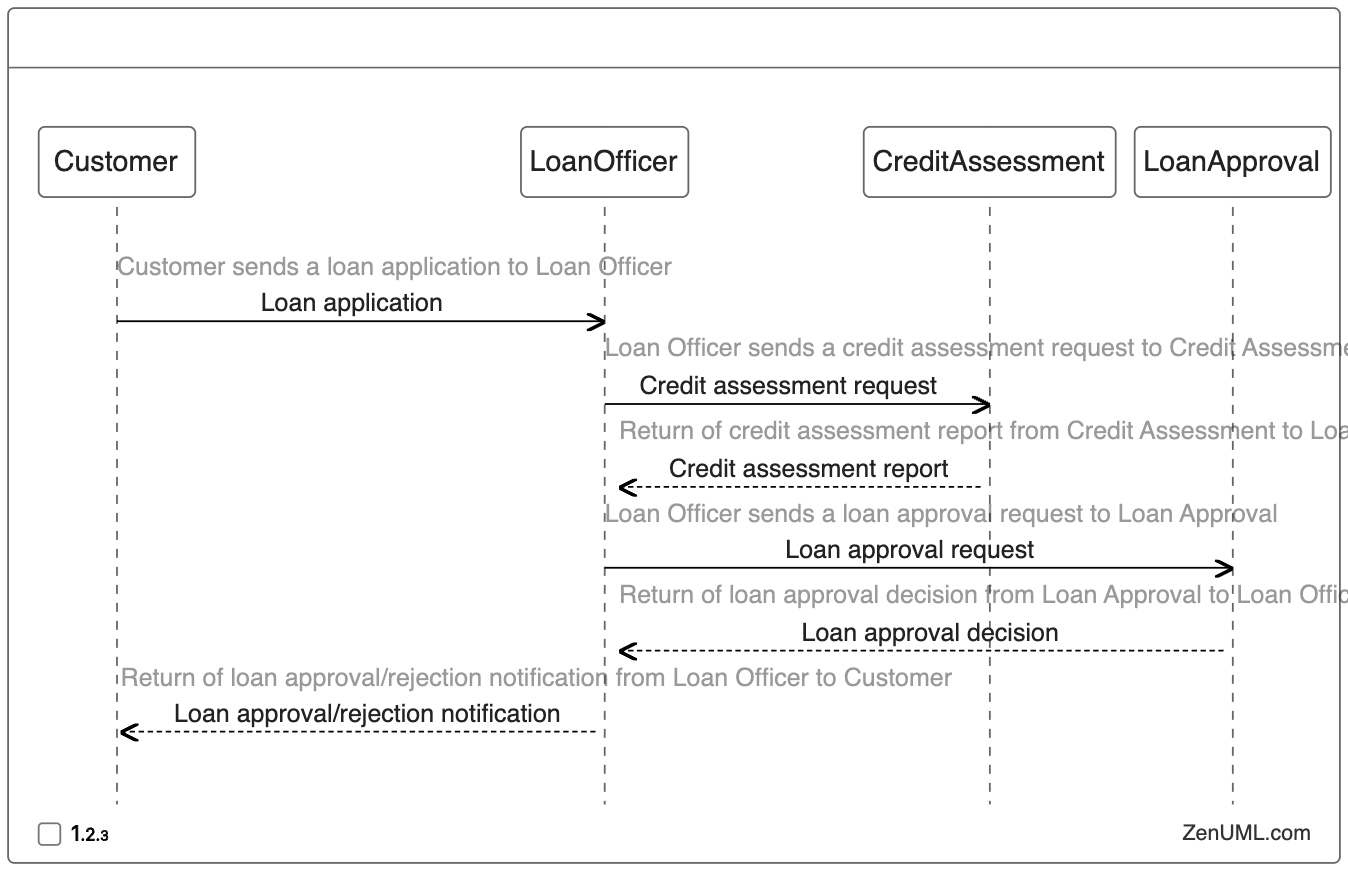

Example 3: Loan Application and Approval Process

Let's consider a loan application and approval process, involving the customer, the loan officer, the credit assessment team, and the loan approval committee.

This sequence diagram depicts the loan application and approval process, highlighting the interactions between the customer, the loan officer, the credit assessment team, and the loan approval committee. By visualizing this process, stakeholders can better understand the steps involved and identify areas for improvement, such as streamlining the credit assessment or decision-making procedures.

Example 4: Mobile Banking Transaction Workflow

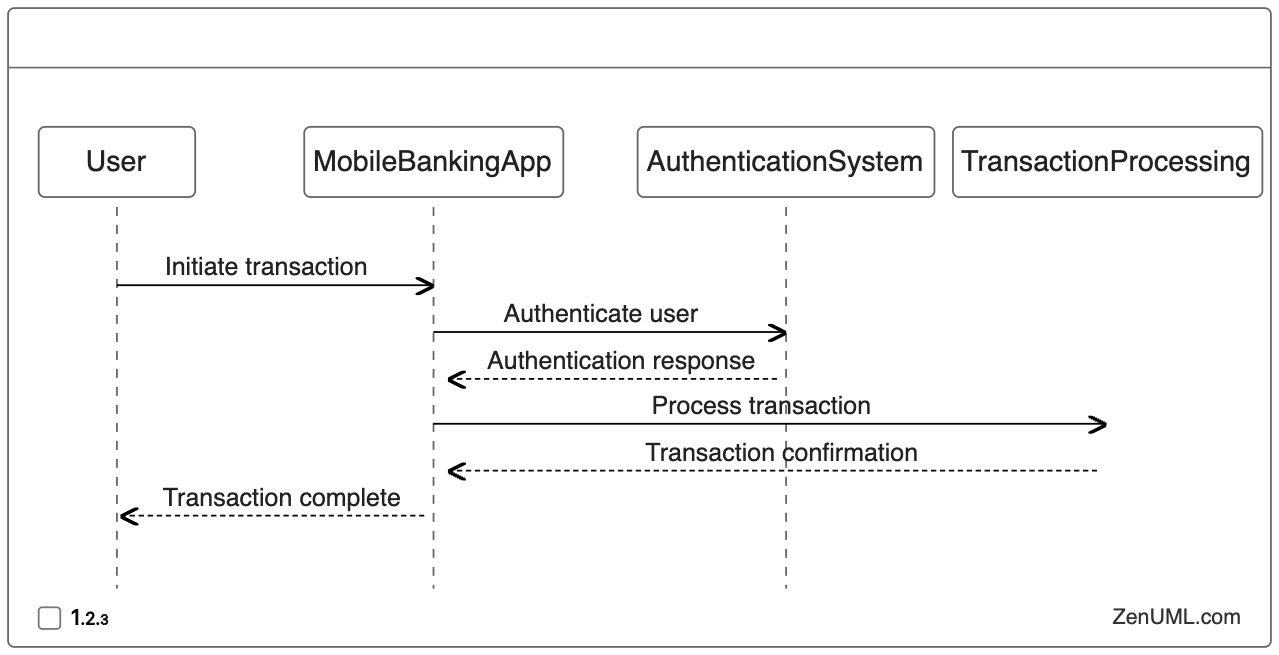

In this example, we'll model the sequence of events involved in a mobile banking transaction, including the user, the mobile banking app, the bank's authentication system, and the transaction processing system.

This sequence diagram illustrates the flow of a mobile banking transaction, from the user initiating the transaction to the final confirmation. It highlights the interactions between the mobile banking app, the authentication system, and the transaction processing system, which is crucial for understanding the security and reliability of the mobile banking platform.

Conclusion

Sequence diagrams have proven to be a valuable tool in the financial industry, offering a clear and concise way to model and document financial transactions. By utilizing sequence diagrams, financial professionals can improve communication, enhance system design, ensure regulatory compliance, and optimize their transaction processes.

The examples provided in this blog post demonstrate the versatility of sequence diagrams in various financial scenarios, from credit card transactions and electronic funds transfers to loan application and mobile banking workflows. By adopting sequence diagrams as part of your financial modeling and documentation practices, you can unlock a new level of understanding, collaboration, and efficiency within your organization.

We encourage you to explore the use of sequence diagrams in your own financial workflows and projects. Remember, the key to effective financial modeling is not just the technical implementation, but also the ability to communicate and collaborate effectively with all stakeholders. Sequence diagrams are a powerful tool that can help you achieve this goal.

We'd love to hear your thoughts and experiences on using sequence diagrams in the financial sector. Feel free to leave a comment below and share your insights with the community.

Try ZenUML now!

Zenuml detailed feature roadmap available here.